23 Wild Ecommerce Fraud Statistics For 2026 (Latest Data)

Online fraud is on the rise as are occurrences of online payment fraud, but how bad is it?

The most common type of fraud affecting ecommerce merchants is chargeback fraud, a type of fraud in which the consumer attempts to receive a refund for a purchase they made by disputing the payment for that purchase with their financial institution.

But how much are merchants losing to cases of fraud? What tactics are merchants including in ecommerce fraud prevention efforts?

We answer all of this and more in this article.

Editor’s top picks – ecommerce fraud statistics

- Ecommerce merchants in the United States experienced over $44 billion in losses as a result of fraud in 2024. (Statista3)

- 98% of merchants experience at least one type of fraud every year. (Visa)

- 41.9% of all scams reported to the BBB in 2023 are linked to online payment scams. (Statista1)

- 47% of ecommerce merchants are victims of refund and policy abuse. (Visa)

- Ecommerce businesses lose 3.2% of their revenue to fraud annually. (Visa)

- Ecommerce merchants only win 17.1% of chargeback disputes in cases of suspected fraud. (Visa)

- Live shopping platform Whatnot uses AI language learning models to prevent 95% of fraud attempts on their platform. (Whatnot)

General ecommerce fraud stats

1. The ecommerce fraud industry is valued at $44 billion

According to a study conducted by Juniper Research, the ecommerce fraud detection and prevention market is currently valued at $44 billion.

The industry will reach a market value of $109 billion by 2029, growing at a rate of 141%.

Source: Juniper Research

2. 41.9% of all scams reported in 2023 were attributed to online purchases

According to Statita’s analysis of claims of scams reported in the Better Business Bureau’s (BBB) Scam Tracker tool, 41.9% of all scams reported to the tracker in 2023 were related to online purchases.

This was an increase in 2020’s 38% and 2022’s “three in 10.”

Source: Statista1

3. 82.6% of consumers who reported online purchase scams in 2023 experienced monetary losses as a result of those scams

When Statista analyzed data from the BBB’s Scam Tracker tool, they discovered that of the online shopping scams that were reported in 2023, 82.6% of those resulted in monetary losses for consumers.

Source: Statista2

4. 98% of merchants experienced at least one type of fraud over a 12-month period

Visa conducted a survey in November of 2024 that included respondents from businesses of all sizes, from enterprise businesses who earn over $50 million in ecommerce revenue annually to smaller businesses who earn as little as $50,000.

Of those respondents, of which there were 576, 98% say their business experienced at least one type of fraud over the 12-month period leading up to the survey.

90% say they experienced one of the five most common types of fraud, which are refund abuse, real-time payment fraud, phishing scams, first-party misuse and card testing.

Source: Visa

5. 57% of financial institutions saw an increase in fraud attacks in 2023

According to Alloy’s 2024 report on the state of fraud, in which they interviewed professionals at financial institutions, 57% of those professionals say their institutions saw an increase in fraud attacks that affected both consumer and business accounts alike.

Source: Alloy

6. 35% of financial institutions experienced more than 1,000 fraud attempts in 2023

Alloy asked professionals at financial institutions about the volume of fraud attempts they experienced in 2023.

The majority, or 35%, saw more than 1,000 fraud attempts.

About 10%, or 1 in 100, as the report states, saw over 10,000 fraud attempts.

Source: Alloy

7. 47% of merchants experience refund or policy abuse

According to a survey conducted by Visa, refund or policy abuse is the most common form of fraud that affects merchants worldwide.

Here are other forms of fraud affecting online retailers and customers alike:

- Refund/policy abuse – 47% of ecommerce merchants experienced this type of fraud over a 12-month period

- Real-time payment fraud – 45%

- Phishing/pharming/whaling – 42%

- First-party misuse – 39%

- Card testing – 33%

- Identify theft – 32%

- Coupon/discount abuse – 32%

- Loyalty fraud – 28%

- Account takeover fraud – 26%

- Affiliate fraud – 23%

- Re-shipping – 21%

- Triangulation schemes – 17%

- Botnets – 17%

- Money laundering – 14%

2% of merchants chose the “none of the above” option.

Source: Visa

8. 3% of online orders processed in 2024 turned out to be fraudulent

Fraudulent transactions are on a slight decline.

According to Visa’s survey, online merchants stated that an average of 3% of all online orders processed in 2024 turned out to be fraudulent.

This is a decrease from 2023’s figure of 3.3%.

Here’s how this figure differs by region:

- Latin America – Merchants from this region reported that an average of 3.9% of all orders processed turned out to be fraudulent

- North America – 3.4%

- Europe – 2.8%

- Asia-Pacific – 2.5%

Source: Visa

Finance-based fraud statistics

9. The United States experienced over $44 billion in ecommerce losses attributed to fraud in 2024

According to data collected by Juniper Research and reported by Statista, ecommerce losses caused by fraud reached $44 billion in 2024 in the United States alone.

The research institute expects that number to surpass $100 billion by 2029.

Source: Statista3

10. 60% of merchants around the world seen an increase in online payment fraud in 2024

According to data collected by Statista, six in 10 merchants globally, or 60%, experienced an increase in online payment fraud in 2024.

The report goes on to say that 55% saw an increase in chargeback fraud.

Source: Statista4

11. 54% of financial institutions experienced over $500,000 in direct fraud losses in 2023

When Alloy surveyed professionals at financial institutions, they discovered that the majority of institutions, or 54%, experienced direct fraud losses that amounted to more than $500,000 in 2023.

25% experienced over $1 million in losses.

Source: Alloy

12. Ecommerce companies lose an average of 3.2% of revenue to fraud annually

Visa’s survey of ecommerce merchants revealed that online retailers lose 3.2% of revenue to fraud annually on average.

This is an increase from 2024’s figure of 3.1%.

This figure changes by region:

- Latin America – Ecommerce merchants in this region lose 4.1% of their revenue to fraud annually*

- North America – 3.6%

- Europe – 2.8%

- Asia-Pacific – 2.6%

*Visa explains that a low sample size of merchants in this region may be contributing to its inflated rate and may not be as accurate as it could be.

Source: Visa

13. 38% of online merchants seen a 5 to 25% increase in first-party misuse in 2024

According to Visa’s survey, 38% of merchants surveyed revealed they saw a 5 to 25% increase in first-party misuse occurrences in 2024.

First-party misuse occurs when a customer purposefully or accidentally initiates a chargeback or other type of dispute against a legitimate transaction.

Source: Visa

14. Ecommerce merchants only won 17.1% of chargeback disputes that were based on suspected fraud in 2024

Chargeback fraud, also known as friendly fraud, is becoming more prevalent.

According to Visa’s survey, online merchants only won 17.1% of chargeback disputes in which those disputes were initiated by suspected fraudsters.

This figure is only a slight decrease from 2023’s figure of 17.4%.

This number differs by region:

- Asia-Pacific – Merchants in this region won 19.6% of chargeback disputes in 2024

- North America – 17.9%

- Europe – 15.1%

- Latin America – 11.5%

Source: Visa

15. Online merchants spend an average of $78 challenging fraudulent disputes

According to Visa’s survey, online merchants spent $78 on average defending themselves against disputes related to first-party misuse in 2024.

This is an increase from 2023’s amount of $74 per dispute.

Source: Visa

16. 46% of fraud and payment professionals believe first-party misuse is on the rise because consumers are learning how to “game the system”

46% of fraud and payment professionals say chargeback fraud is becoming more common because consumers are learning how to use the chargeback system in their favor.

Here are other reasons why professionals believe these numbers are on the rise:

- Increase in sales volume – 41% of fraud and payment professionals believe this is why first-party misuse is on the rise

- Banks make it too easy to submit disputes – 36%

- Higher prices/inflation – 33%

- Emergence of “fraud as a service” – 36%

- Changes in cardholder protections – 27%

- Merchant changed or added new sales channel – 27%

- Merchant added new customer bases – 25%

- Merchant started accepting a new payment method – 24%

Source: Visa

Fraud prevention statistics

17. 52% of financial institutions rely on third-party solutions to combat fraud

Alloy’s survey revealed that although 48% of financial institutions have in-house solutions for combating fraud, 52% allocate funds to third parties for fraud management.

Source: Alloy

18. 50% of financial institutions were able to catch fraud threats in real time in 2023

According to Alloy’s survey of professionals about financial institutions, 50% of institutions were able to successfully stop fraud attempts in real time.

Source: Alloy

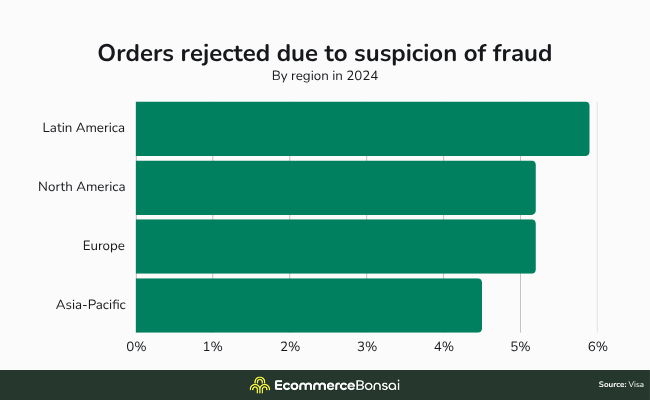

19. Online merchants rejected 5% of orders on suspicion of fraud in 2024

Fraud detection and prevention are getting more sophisticated.

While 2024’s figure is a decrease from 2023’s figure of 5.8%, Visa’s survey revealed how merchants were able to reject 5% of all orders received for possible fraud.

Here’s how this figure differed among regions:

- Latin America – Merchants in this region rejected 5.9% of orders on suspicion of fraud

- North America – 5.2%

- Europe – 5.2%

- Asia-Pacific – 4.5%

Source: Visa

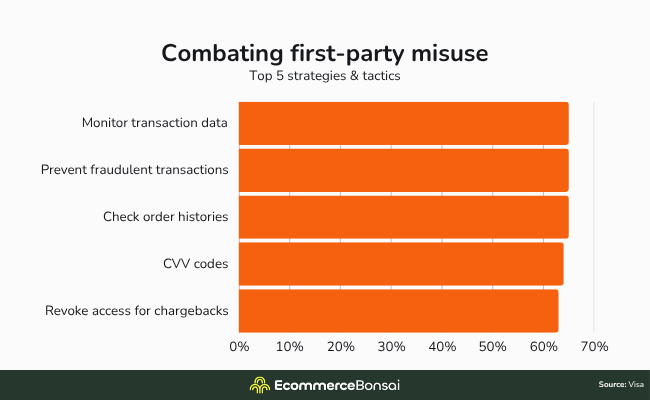

20. 65% of merchants say monitoring transaction data for unusual activity is the best way to combat first-party misuse

Visa’s survey asked fraud and payment professionals about the fraud prevention strategy their companies use and which tactics work best for them.

65% say monitoring transaction data and analyzing it to detect unusual activity has been the most effective way to combat fraud as it occurs.

65% of respondents also work with providers to identify and prevent fraudulent transactions.

Other strategies given include requiring customers to fill out the card verification values (CVV) from the back of their cards in order to complete purchases, revoking access to customers who file chargebacks, and making sure cancellation policies are easy to find.

Source: Visa

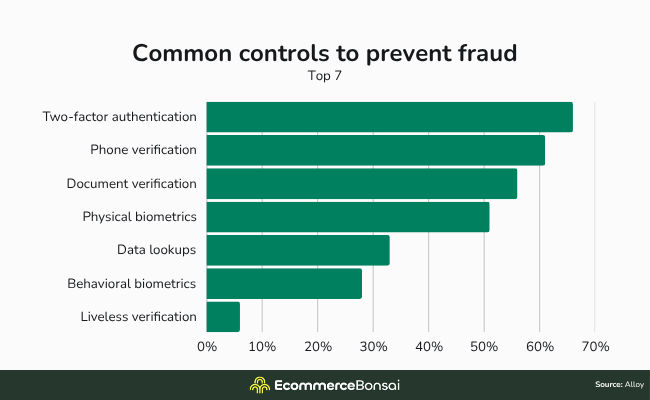

21. 66% of financial institutions rely on two-factor authentication to prevent fraud

In Alloy’s State of Fraud report for 2024, they asked professionals at financial institutions about the systems they have in place to prevent fraud attempts and identity theft and protect personal and payment data.

The most common response was two-factor authentication (2FA), with 66% of financial institutions relying on this technology.

Here are other tools banks and other institutions are using to secure accounts and prevent fraud:

- Phone verification – 61% of financial institutions are using this method to protect customers against fraud

- Document verification – 56%

- Physical biometrics – 51%

- Data lookups – 33%

- Behavioral biometrics – 28%

- Liveless verification (such as selfies) – 6%

Source: Alloy

22. 48% of merchants want to increase their use of AI and machine-learning tactics to combat fraud

According to a survey of 1,082 merchants, the results of which were reported by Statista, 48% of those merchants plan to increase their knowledge and use of artificial intelligence (AI) and machine learning to implement fraud detection and prevention.

46% would like to go as far as to automate fraud prevention.

Source: Statista5

Related: Innovations in Ecommerce You Need to Know

Live shopping fraud statistics

23. Thanks to AI, Whatnot is able to detect 95% of fraud attempts within minutes of them occurring

According to a post published by Whatnot Engineering on Medium, live shopping platform Whatnot uses large language models (LLMs) to detect scams threatening customers and sellers in real time.

The platform’s LLMs take things like account age, the flow of conversations, user engagement history and message attachments into consideration when determining if a user is attempting to scam another user.

Certain qualifiers in these categories will cause Whatnot’s fraud detection system to flag accounts automatically.

This sends the account’s messages into another LLM that determines the probability of fraud within the user’s messages.

If the results are positive, they’re passed onto Whatnot’s ops team, who take on the task of investigating the fraudulent user and determining what happens to them.

Overall, the platform’s system is able to detect 95% of fraud attempts within minutes of them occurring.

Source: Whatnot

Final thoughts

Ecommerce fraud is at an alltime high and it is, unfortunately, quite lucrative for scammers.

The good news is that advances in technology are helping to fight fraud cases and stop scams. This is good for businesses and it’s good for consumers.

And companies are using LLM’s to do it. Finally, a use case for AI that doesn’t involve summarising text or ripping off the work of creatives.

Want to learn more statistics? Check out our other posts: